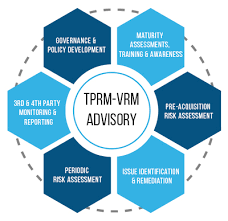

Third Party Risk Management Market Outlook: Strategies for Enterprise Resilience

Financial performance indicators demonstrate healthy market conditions supporting continued investment and innovation in third-party risk management. The Third Party Risk Management Market Revenue generation patterns reveal diverse contribution sources across licensing models and service offerings globally. The Third Party Risk Management Market size is projected to grow USD 10.49 Billion by 2035, exhibiting a CAGR of 6.21% during the forecast period 2025-2035. Subscription revenues constitute substantial market portions as cloud deployment models become predominant across industry. Professional services revenues including implementation and program development represent significant revenue streams. Managed service revenues are growing as organizations seek outsourced vendor risk management capabilities.

Revenue distribution across customer segments reflects varying organization sizes and third-party management complexity requirements. Large enterprise segment generates substantial revenues through comprehensive platform deployments and extensive services. Mid-market segment contributions are growing as solutions become more accessible and affordable. Small business segment represents emerging revenue opportunity as simplified offerings reach this market. Financial services vertical generates premium revenues given complex regulatory requirements and large vendor populations.

Revenue model evolution indicates transition toward subscription-based pricing with usage-based components for scalability. Annual subscription pricing provides predictable recurring revenue while reducing customer implementation barriers effectively. Per-vendor pricing aligns costs with portfolio size enabling scalability as organizations grow. Transaction-based pricing for assessments and monitoring enables usage-aligned cost structures. Hybrid models combine platform subscriptions with transactional components for flexibility.

Revenue quality indicators suggest improving financial characteristics as subscription models gain predominance across markets. Recurring revenue percentages are increasing through subscription conversions and new cloud deployments substantially. Customer retention rates demonstrate strong satisfaction and switching cost influence on relationships. Average contract values are growing through additional module adoption and capability expansion. Gross margin improvement reflects operational efficiencies and economies of scale in delivery.

Top Trending Reports -

Job Evaluation Software Market Segmentation