In-Flight Entertainment Market Size & Forecast 2025-2035: Growth Drivers and Industry Outlook

Introduction

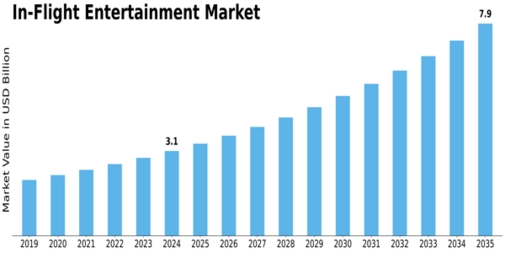

Within the broader in-flight entertainment market, segmentation by platform, product type, technology and service reveals where growth is concentrated. According to MRFR, the in-flight entertainment market size was USD 3.15 billion in 2024, forecast to reach USD 7.88 billion by 2035 with a CAGR of 8.70%. Let’s dive into the segments shaping the industry’s future.

Platform Segmentation

The in-flight entertainment market analysis highlights platform segmentation: narrow-body aircraft, wide-body aircraft and business jets. In 2022, the narrow-body aircraft segment led revenue, driven by low-cost carriers deploying entertainment systems to improve their product offering. As more narrow-body planes join fleets globally, this platform segment continues to be a growth engine.

Product Type Segmentation

By product type, the market is segmented into hardware, connectivity and communication. The hardware segment is expected to enjoy a strong CAGR (around 10%) during the forecast period and holds the largest share. Connectivity and communication are crucial for enabling on-board WiFi, streaming and real-time services.

Technology Segmentation

In-flight entertainment market technology segmentation divides the market into air-to-ground technology and satellite technology. According to MRFR, satellite technology is expected to grow fastest (around 10% CAGR) because of its coverage advantage and suitability for long-haul flights.

Service Type Segmentation

On the service side, the market includes video display systems, data connectivity, flight tracker services and others. Video display systems lead in market share but data connectivity is gaining momentum as passengers demand personalised streaming experiences.

Why This Segmentation Matters

Understanding these segments helps airlines, OEMs, content providers and investors allocate resources effectively. For example:

-

Hardware providers should focus on cabin retrofit programs and narrow-body aircraft.

-

Connectivity providers should target satellite systems and global coverage.

-

Content/Service providers should partner with airlines for bespoke entertainment solutions and in-flight retail.

Conclusion

Segment-level insights in the in-flight entertainment market reveal exactly where growth is happening. From narrow-body aircraft and hardware installs to satellite connectivity and streaming services, each segment offers actionable opportunities. Stakeholders who understand and engage with these segments will be best placed to capture value as the market grows.